Navigating the world of investments can feel daunting, especially when encountering unfamiliar terms like a "demat account." Fear not, this guide seeks to simplify demystify demati accounts for those just starting out. A demat account is essentially a digital locker where your shares are held electronically. It substitutes the need for physical share certificates, making trading more efficient.

- Additionally, a demat account provides clear visibility to your portfolio, permitting you to track your investments seamlessly

- Creating a demat account is a relatively easy process that involves choosing a brokerage firm and submitting the required documentation.

With a grasp of demati accounts, you can confidently embark on your investment journey.

Unlocking Your Investment Potential: Open a Demat Account Today start your

Are you eager to venture into the world of investing? A demat account is your key to unlocking a universe of opportunities. It allows you to buy shares of companies and participate in the exciting realm of the stock market. Opening a demat account is a straightforward process, typically involving minimal paperwork and documentation. With a few simple steps, you can gain access to a wealth of financial instruments and embark on your investment journey. Don't wait any longer – take control of your financial future by opening a demat account today!

Unlock Your Investing Journey: A Step-by-Step Guide to Opening a Demat Account

Embarking on your investment pursuit requires a crucial first step: opening a Demat account. This account serves as your digital vault for securities, allowing you to buy and sell stocks, bonds, and other financial instruments seamlessly. Let's a straightforward guide to completing this essential process:

- Research different Demat account providers: Compare fees, features, and reputation to find the best alignment for your needs.

- File an application form: Frequently, this can be done online or offline. Ensure you provide accurate and complete information.

- Complete KYC verification: This involves submitting identity proof, address proof, and other papers to verify your identity.

- Submit necessary documents: Typically includes scanned copies of your PAN card, bank statements, and other relevant paperwork.

- Await account approval: The provider will examine your application and inform you about the status. This process may take a few days.

- Enter your Demat account: Once approved, you'll receive login credentials to access your account and begin trading.

Excellent!, you've successfully opened a Demat account. Now you're equipped to invest in the financial markets and expand your wealth!

A Demat Account Explained

A demat account/securities account/shareholder account is a necessary component for trading/investing/participating in the stock market/equity market/capital markets. It allows you to hold/store/manage your shares/equities/financial instruments in electronic format/structure/manner, rather than physical certificates/documents/paperwork. This streamlines/simplifies/modernizes the investment process, making it faster/easier/more efficient.

- Opening/Creating/Setting up a demat account is a straightforward/simple/easy process/procedure/step that typically involves document verification/identity checks/ KYC procedures

- Once opened, your demat account will be linked/associated/connected to your trading account/brokerage account/investment platform

- You can then buy/sell/trade securities through your brokerage account/online platforms/market exchanges

Dematerialization offers numerous/various/multiple benefits/advantages/pros, including convenience/efficiency/reduced paperwork, increased security/safety/protection against loss or theft, and the ability to track/monitor/view your portfolio easily/efficiently/with ease.

Accessing The Simple Process of Opening a Demat Account

Opening a demat account seems to be a straightforward process in today's tech-driven world. It allows you to invest in securities like stocks and debentures. To get started, you will need to opt for a reputable trading platform.

Next, apply online with your personal details and documents. The broker will then validate your details and activate your demat account.

Once opened, you can begin trading. Congratulations! Your journey into the world of securities has begun.

Entering Your Gateway to Stock Market Investments: Demat Accounts Explained

Demat accounts are vital for anyone looking to invest in the stock market. They provide a protected platform for storing your shares electronically. Before diving into the world of stocks, knowing how a Demat account works is important.

A Demat account is basically a bank account designed specifically for holding securities like shares and bonds. Instead of owning physical share certificates, your holdings are displayed electronically in your Demat account. This simplifies the selling process, making it quicker.

Here's describe the key pros of opening a Demat account:

* **Convenience:** Trade shares from anywhere with an internet connection.

* more info **Security:** Your securities are protected against loss or damage.

* **Efficiency:** Transactions are processed quickly and seamlessly.

* **Transparency:** Track your portfolio performance in real-time.

Getting a Demat account is a easy process. You'll need to choose a trusted Depository Participant (DP) who will set up your account.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Michelle Pfeiffer Then & Now!

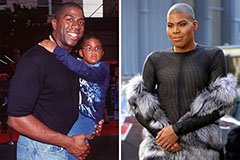

Michelle Pfeiffer Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!